As a field underwriter a producer is – As a field underwriter, a producer is responsible for assessing and mitigating risks in the insurance industry. This role involves collaborating with producers, gathering data, and applying underwriting guidelines to determine the insurability of individuals or businesses.

Field underwriters play a crucial role in the underwriting process, ensuring that insurance companies make informed decisions and maintain financial stability. They work closely with producers to understand the unique risks associated with each applicant, ultimately contributing to the fair and equitable distribution of insurance coverage.

Field Underwriter Responsibilities

Field underwriters play a crucial role in the insurance industry, ensuring that risks are accurately assessed and appropriate underwriting decisions are made. Their core responsibilities include:

Risk Assessment:Field underwriters evaluate and analyze risks associated with insurance policies. They consider factors such as the applicant’s financial stability, medical history, property condition, and industry trends to determine the likelihood and severity of potential claims.

Underwriting Guidelines

Field underwriters adhere to established underwriting guidelines set by insurance companies. These guidelines provide a framework for assessing risks and making underwriting decisions. By following these guidelines, field underwriters ensure consistency and fairness in the underwriting process.

Producer Collaboration

Field underwriters and producers play crucial roles in the underwriting process. Producers act as the primary point of contact for policyholders, gathering information and submitting applications to insurance companies. Field underwriters then evaluate the risk associated with each application, determining whether to approve or decline coverage and setting appropriate premium rates.

Collaboration with Producers

To effectively assess risks, field underwriters collaborate closely with producers. Producers provide field underwriters with insights into the policyholder’s business, financial situation, and risk profile. This information is essential for field underwriters to make informed underwriting decisions.

Field underwriters also work with producers to educate them on underwriting guidelines and best practices. This helps producers to identify and mitigate potential risks, which can lead to better underwriting outcomes for both the producer and the insurance company.

Benefits of Strong Relationships, As a field underwriter a producer is

Strong relationships between field underwriters and producers are mutually beneficial. For field underwriters, close relationships with producers provide access to a wider pool of potential policyholders and can lead to increased business opportunities. For producers, strong relationships with field underwriters can provide them with access to expert underwriting advice and support, which can help them to close more deals and build stronger relationships with their clients.

Risk Assessment Methods

Field underwriters employ various risk assessment methods to evaluate the potential for loss and determine appropriate insurance coverage. Accurate and relevant data is crucial for comprehensive risk assessment, and underwriters utilize a range of tools and techniques to gather and analyze this information.

Data Collection

Field underwriters collect data from multiple sources, including:

- Inspection Reports:On-site inspections provide firsthand observation of property conditions and potential hazards.

- Financial Statements:Financial data helps assess the financial stability of businesses and individuals.

- Loss History:Past claims experience provides insights into the likelihood and severity of future losses.

- Industry Reports:Industry-specific reports offer information on trends, risks, and best practices.

Risk Assessment Tools

Field underwriters use a variety of tools to analyze and evaluate risk data:

- Rating Systems:Insurance rating systems assign risk scores based on factors such as property type, location, and construction.

- Catastrophe Models:These models simulate potential catastrophic events and assess their impact on insured properties.

- Statistical Analysis:Statistical techniques help identify patterns and trends in loss data.

- Expert Judgment:Underwriters rely on their experience and knowledge to make informed judgments about risk.

Risk Assessment Techniques

Field underwriters apply various techniques to assess risk, including:

- Risk Profiling:Creating a detailed profile of the insured, including their industry, operations, and risk exposures.

- Risk Identification:Identifying potential hazards and vulnerabilities that could lead to loss.

- Risk Quantification:Estimating the probability and potential severity of losses.

- Risk Mitigation:Developing strategies to reduce or eliminate identified risks.

Underwriting Guidelines and Compliance

Underwriting guidelines serve as a crucial foundation for the underwriting process, providing field underwriters with standardized criteria to assess and evaluate risks. Adhering to these guidelines ensures consistency, objectivity, and compliance with regulatory requirements.

Field underwriters play a pivotal role in ensuring compliance with underwriting guidelines. They are responsible for reviewing and analyzing applications, conducting inspections, and making recommendations based on the guidelines established by the insurance company. By adhering to these guidelines, field underwriters help mitigate risks, maintain underwriting profitability, and protect the interests of policyholders and the insurance company.

Common Underwriting Guidelines

- Age and Health:Guidelines may specify age and health requirements for certain types of insurance, such as life or disability insurance.

- Occupation and Industry:Guidelines may consider the risk associated with different occupations and industries, such as hazardous occupations or high-risk industries.

- Property Condition:Guidelines may establish standards for property condition, such as building materials, maintenance history, and location.

- Financial Stability:Guidelines may assess financial stability, such as income, assets, and debt-to-income ratio.

Communication and Documentation

Effective communication is paramount for field underwriters. It enables accurate information exchange, promotes understanding, and facilitates collaboration among stakeholders.

During the underwriting process, various documentation is required to support risk assessments and underwriting decisions. These include:

- Policy Applications:Contain details of the insured, coverage requested, and risk exposure.

- Loss Runs:Historical loss data that helps assess the insured’s past claims experience.

- Inspections:Reports that provide insights into the physical condition of the insured property.

- Financial Statements:For commercial risks, these documents provide information on the insured’s financial health.

Best practices for documenting underwriting decisions and risk assessments include:

- Clear and Concise Language:Use precise and unambiguous language to convey findings and recommendations.

- Thoroughness:Include all relevant information and supporting evidence to justify underwriting decisions.

- Objectivity:Present information in a factual and impartial manner, avoiding personal opinions or biases.

- Timeliness:Document findings promptly to ensure timely decision-making.

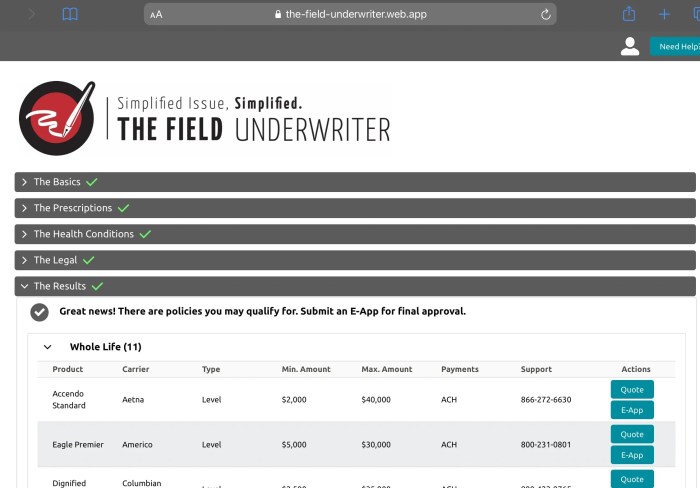

Technology and Automation: As A Field Underwriter A Producer Is

Technology has revolutionized the underwriting process, enabling field underwriters to work more efficiently and accurately. Automation has streamlined tasks, reduced errors, and improved the overall quality of underwriting decisions.

Role of Technology in Underwriting

- Data collection and analysis: Technology enables field underwriters to gather and analyze large amounts of data from various sources, including insurance applications, inspection reports, and third-party databases.

- Risk assessment: Automated underwriting systems use advanced algorithms to assess risk and generate underwriting recommendations, reducing the need for manual calculations and subjective judgments.

- Policy issuance: Automation can streamline the policy issuance process, generating policies and endorsements quickly and accurately.

Benefits of Automation for Field Underwriters

- Enhanced efficiency: Automation eliminates repetitive and time-consuming tasks, allowing field underwriters to focus on more complex and value-added activities.

- Improved accuracy: Automated systems reduce errors and inconsistencies, ensuring that underwriting decisions are based on reliable and up-to-date information.

- Increased productivity: Automation frees up field underwriters’ time, enabling them to handle more cases and improve their overall productivity.

Impact of Technology on the Field Underwriting Role

While technology has enhanced the field underwriting role, it has also led to some changes:

- Increased reliance on data: Field underwriters now rely heavily on data and analytics to make underwriting decisions, which may require additional training and skills.

- Changing job responsibilities: Automation has shifted some traditional underwriting tasks to automated systems, freeing up field underwriters to focus on more strategic and advisory roles.

- Potential job displacement: In the long term, automation could potentially displace some field underwriters, as certain tasks become fully automated.

Question & Answer Hub

What are the key responsibilities of a field underwriter?

Field underwriters are responsible for assessing and mitigating risks, collaborating with producers, gathering data, and applying underwriting guidelines.

How do field underwriters collaborate with producers?

Field underwriters work closely with producers to understand the unique risks associated with each applicant and to determine the appropriate coverage.

What are the benefits of strong producer relationships for field underwriters?

Strong producer relationships can help field underwriters gain access to more accurate and relevant information, which can lead to better risk assessment and underwriting decisions.